Biden’s Tax Plan, Baby Boomers, and When to Sell

Over the last month, just about every business media outlet has written about Biden’s expected tax plan. Here are the key points that we are keeping an eye on, as they pertain to middle-market M&A transactions.

Business owners will be affected by any change to capital gains taxes

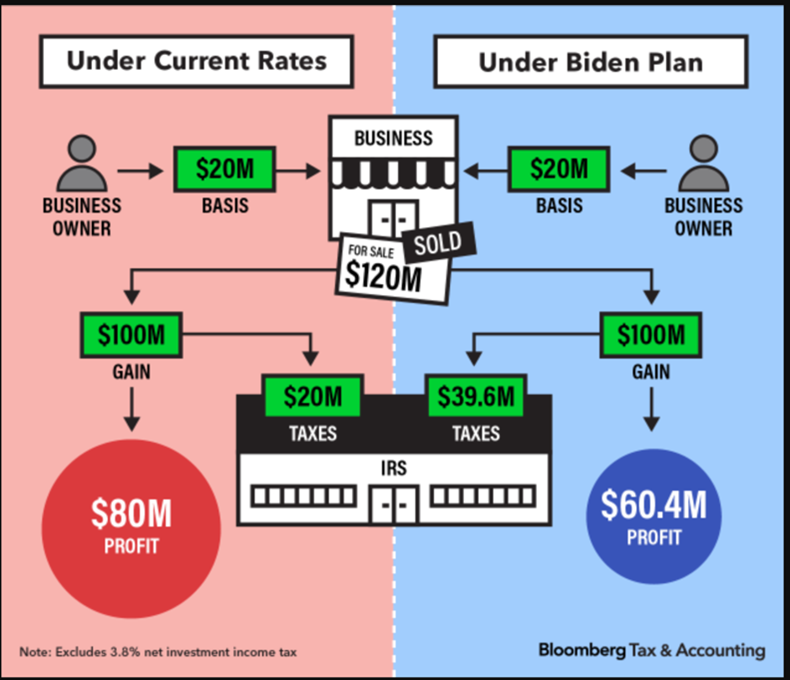

As the plan stands now, the president-elect wants to raise the current 20 percent tax rate on long-term capital gains to the rate applied to ordinary income for those making more than $1 million. His proposal would also increase the top rate on ordinary income to 39.6 percent, up from 37 percent.

Under Biden’s proposal, owners who make more than $1 million would face nearly double the taxes after selling their businesses. Capital gains taxes are applied to the difference between the sale price and basis—or the value of an owner’s investment—in an asset. Because founders may have very little basis in their businesses, their capital gains taxes upon sale can be substantial, as shown in the graphic below.

Credit: Bloomberg Tax & Accounting

The entire middle market will be affected, but particularly Baby Boomer owners

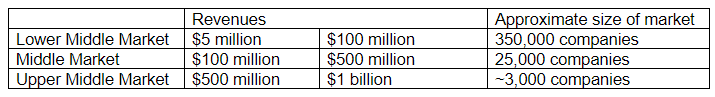

We expect the entire middle market to be affected by these tax changes, but the larger lower middle market will feel them most acutely.

Estimates as reported in Chief Executive Magazine

Experts have been touting businesses in the lower middle market as ripe with opportunity for M&A investors for the last several years. Made up of highly-fragmented firms, often in highly profitable industries, the lower middle market is also full of Baby Boomers (those born between 1946 and 1964)–many of whom are at or near retirement age. In the third quarter of 2020, about 28.6 million Baby Boomers reported that they were out of the labor force due to retirement. This is 3.2 million more Boomers than the 25.4 million who were retired in the same quarter of 2019. Pew Research attributes this jump to the COVID-19 global pandemic and recession.

As we’ve written about in the past, a lack of succession planning means these owners often have an urgent reason to sell once they decide to make their move. Lower middle-market owners in particular often only have one shot to sell their business at retirement. They may not sell another one and need to make as much as possible from the sale to secure their families’ finances. We expect the Biden tax plan could add another layer of urgency over the next year as owners rush to sell before the plan is implemented.

Once the plan is in effect, some experts believe the opposite may happen–with owners who could stand to earn significant profits on the sale of their businesses sitting tight until a new administration takes over and the tax plan is again adjusted.

We are keeping a close watch on these tax plan developments and what they mean for the middle market. If you are considering buying or selling a business, please contact us for a confidential discussion of possibilities appropriate to your specific situation.